Awesome Vat Reconciliation Excel Template

You can easily record your VAT sales as well as sales return transactions in it.

Vat reconciliation excel template. The VAT invoice is a document that notifies an obligation to make a payment. By continuing to use this site you are consenting to our use of cookies. A registrant or registered taxpayer means a taxable person who is registered for VAT and is required to charge VAT and.

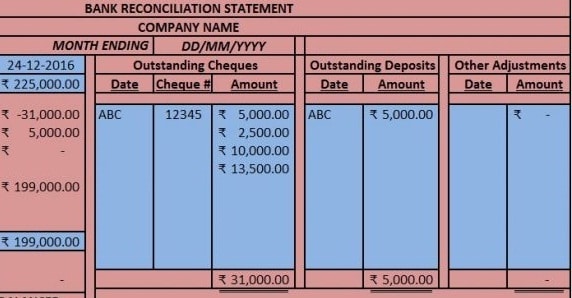

Income Tax Computation Calculator 2021. Click the most recent VAT Reconciliation. A reconciliation template can really make it easier for you to reconcile your bank records effectively.

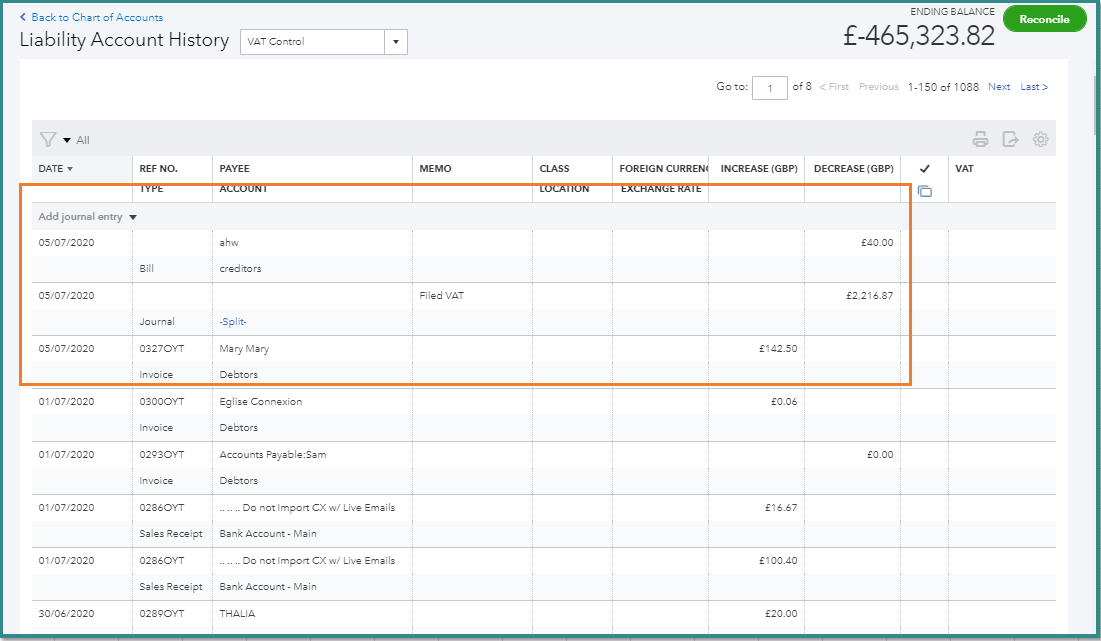

Performing a Value-Added Tax VAT reconciliation. There is a worked example of a bank reconciliation. The MyBI VAT App taps directly into the transactional database of Pastel Partner Pastel Xpress.

If one or the other needs adjusted because theyre wrong then post the adjustments or list. VAT stands for Value Added Tax and the invoice mentions the details about how much tax is to be applied for a particular item or the service rendered. This gives the user the ability to analyse and reconcile VAT at transactional level for a period of up to 5 years.

However I have a reconciliation that I have been using for the last ten years in Excel this is a very useful tool as most accounting software packages only report on the 2 months or 1 month that you pull for the report. With the implementation of VAT in UAE from 1st Jan 2018 formats of all the business documents like invoice debitcredit notes etc have changed. Up to 15 cash back The VAT return is based on the UK laws and rules.

Our Free Excel Bookkeeping Templates are great if you want to handle basic bookkeeping tasks using MicrosoftThey are available to download for business or personal use. Every document has to be in accordance with the rules and regulations issued by the government under the UAE VAT. With these you can even identify the errors much easily.